Airbag Exporters Face Risks Over Dangerous Goods Declarations

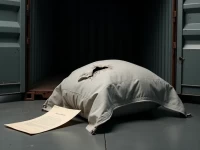

Exporting car airbags requires attention! A case warns that failure to declare dangerous goods information as required may result in fines. Airbags are classified as Class 9 dangerous goods, requiring a Dangerous Goods Packing Certificate for export, truthful declaration, and professional packaging. Enhancing awareness of dangerous goods, seeking professional guidance, and choosing compliant services are crucial to avoid potential pitfalls. Ensure proper documentation and adherence to regulations for a smooth and compliant export process.